Table Of Content

Private mortgage insurance (PMI) is an insurance policy required by lenders to secure a loan that’s considered high risk. You’re required to pay PMI if you don’t have a 20% down payment and you don’t qualify for a VA loan. The reason most lenders require a 20% down payment is due to equity.

Next Up in Mortgages

They typically have 10-, 15-, 20- or 30-year loan terms, but other terms may be available. If your down payment is less than 20% of the home’s purchase price, your lender may require you to purchase private mortgage insurance for a conventional loan. Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldn’t pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Calculate your mortgage

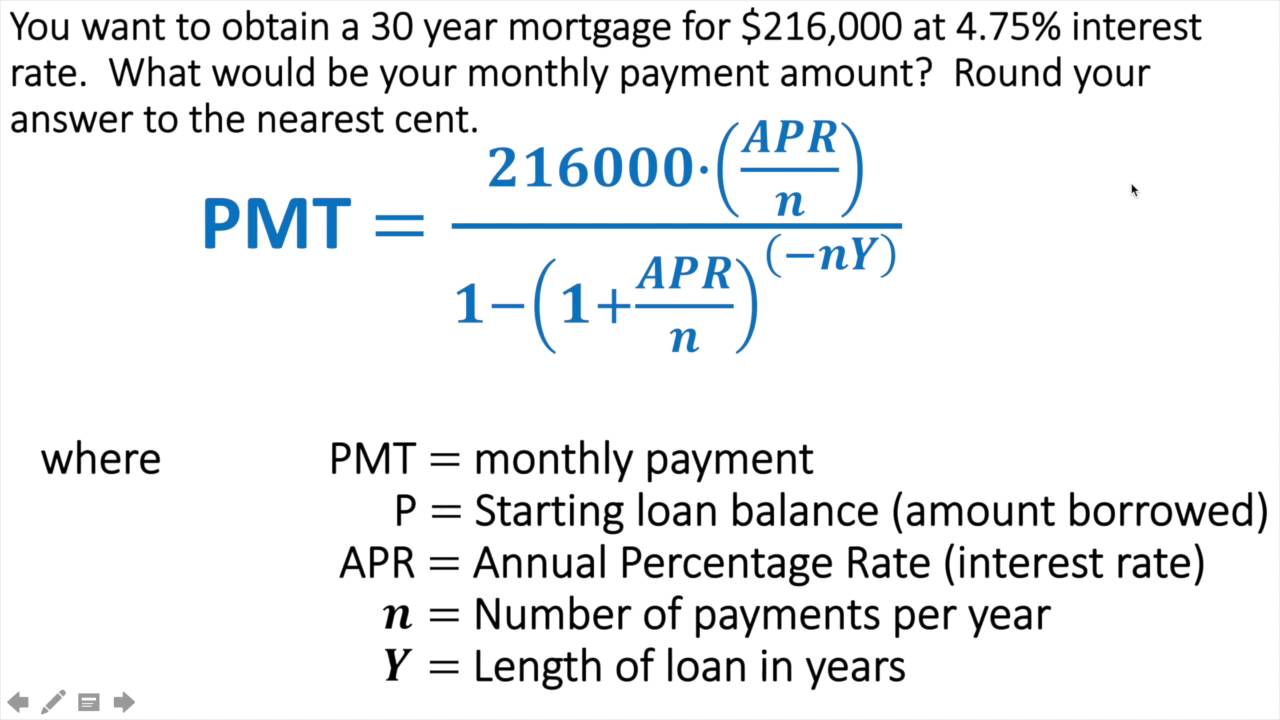

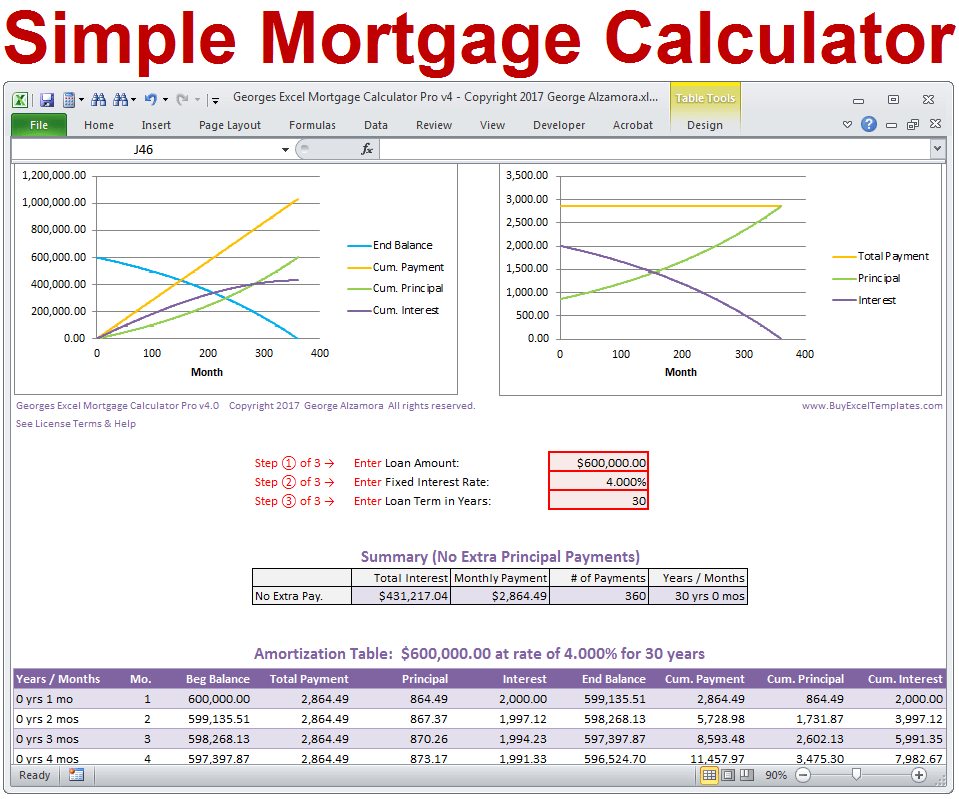

In order to make an amortization schedule, you'll need to know the principal loan amount, the monthly payment amount, the loan term and the interest rate on the loan. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. This mortgage payment calculator assumes that you have a 20% down payment, unless you specify otherwise. If you have less than a 20% down payment, you may have to pay private mortgage insurance (PMI), which would increase your monthly mortgage payment. You can expect a smaller bill if you increase the number of years you’re paying the mortgage.

Loan Term

Loan term (years) - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf.

Arizona Mortgage Calculator - The Motley Fool

Arizona Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Here are the factors that influence the average rates on home loans. Experts recommend shopping around to make sure you’re getting the lowest rate. By entering your information below, you can get a custom quote from one of CNET’s partner lenders.

Get Accurate, Real-Time Rates With Rocket Mortgage®

Alternatively, you can use this mortgage calculator to help determine your budget. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. This is what average mortgage rates looked like as of Thursday... CNET editors independently choose every product and service we cover.

For the required DTI ratios, jumbo mortgages are the same with conforming loans. They both need a front-end DTI ratio of 28 percent, and a back-end DTI ratio of 43 percent. When you apply for a conventional loan, expect lenders to make background checks on your credit history and income.

Your down payment is subtracted from the total amount you borrow. A down payment is money you pay at closing to decrease the total size of the loan. When you get a mortgage, the lender pays for the cost of the home upfront.

One day, Christine had lunch with a friend who works as a financial advisor. Her friend explained that she could eliminate more interest charges by paying the existing high-interest debt on her three credit cards. Some of the cards charged rates as high as 20%, while the mortgage only charged a 5% interest rate. These payments ate up an unnecessarily large amount of her income. By paying off these high-interest debts first, Christine reduces her interest costs more quickly.

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. A mortgage calculator can help you get a realistic idea of the type of home you can afford. The Rocket Mortgage calculator estimate shows principal and interest and has the option to include estimated property tax and homeowners insurance costs, based on your zip code. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property’s price, current interest rates, and other factors.

No comments:

Post a Comment